HONG KONG: Asian markets moved in different directions on Friday (Aug 22) as investors awaited a crucial speech from the U.S. Federal Reserve chief, which is expected to provide clues on potential interest rate cuts in the world’s largest economy.

Trading across the region has been cautious in recent days, with investors weighing a mixed global outlook. Concerns over persistent inflation remain, even as optimism continues to build around the rapid growth of the technology sector, particularly artificial intelligence.

US Federal Reserve Chairman Jerome Powell will deliver a highly anticipated speech on Friday at the annual central bankers’ symposium in Jackson Hole, Wyoming. The address is being closely watched by investors and policymakers for signals on whether the Fed might move toward an interest rate cut at its September meeting. Powell has faced mounting pressure this year from President Donald Trump, who has repeatedly urged the Fed to ease monetary policy, an uncommon political challenge to the independence of the central bank. Asian stock markets traded within mostly narrow ranges on Friday afternoon, just hours before Jerome Powell’s closely watched speech.

In Tokyo, the Nikkei index inched up 0.1%, recovering slightly from Thursday’s 0.7% drop. Fresh data showed that Japan’s core inflation eased to 3.1% in July, down from 3.3% the previous month, though still above the Bank of Japan’s 2% target — fueling speculation of a possible rate hike in October. In China, the Shanghai Composite climbed 1.5%, breaking above 3,800 points for the first time in a decade, supported by strong gains in semiconductor stocks, led by Cambricon Technologies. Elsewhere in the region, benchmarks in Hong Kong, Seoul, and Bangkok advanced, while markets in Sydney and Taipei closed lower. Early trading in Europe saw indices in London and Paris edge into negative territory.

After several volatile sessions on Wall Street, some analysts expect Asia to serve as a relative “safe harbour” while the U.S. Federal Reserve’s credibility comes under scrutiny. “Hesitation to push risk higher will remain,” noted Chris Weston, head of research at Pepperstone, who added that there is only a “very low probability” that Fed Chair Jerome Powell will explicitly signal rate cuts in his upcoming speech.

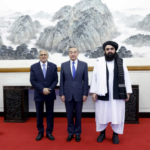

Beyond the Fed, investors are also closely watching developments in Ukraine, where hopes of a potential peace deal are growing more than three years after Russia’s invasion. On Thursday, President Donald Trump set a two-week deadline to evaluate progress in negotiations between Moscow and Kyiv. His comments followed days of intensive diplomacy, including direct meetings with both Russian and Ukrainian leaders as well as consultations with several European counterparts.

Markets are also weighing what such a breakthrough might mean for oil prices, particularly if sanctions on Russia one of the world’s largest producers were eased. For now, oil markets showed little movement on Friday afternoon, flattening after several sessions of gains earlier in the week.

Leave a comment