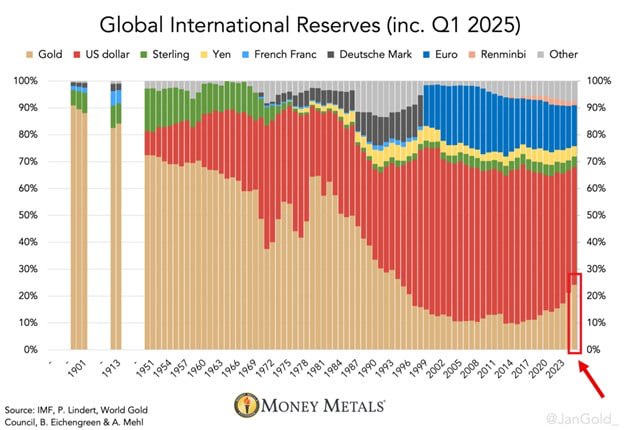

The global financial order is undergoing a significant recalibration as central banks continue to diversify away from the US dollar and lean more heavily on gold. Fresh data from the IMF’s Currency Composition of Official Foreign Exchange Reserves (COFER) for the first quarter of 2025 shows gold’s share in international reserves has surged to 24 percent, its highest level in three decades. This marks a third consecutive year of increase, underscoring a structural, not merely cyclical transformation in how nations hedge sovereign risk.

The dollar, long regarded as the unrivaled cornerstone of global reserves, has fallen to 42 percent — its lowest point since 1995 — reflecting a steady erosion of trust in the greenback. The decline, nearly 200 basis points in just a year, has accelerated amid concerns over Washington’s ballooning debt, persistent inflation, and the increasing use of the US financial system as a geopolitical weapon through sanctions. By contrast, the euro has stagnated at around 15 percent, signaling that the shift is not toward alternative fiat currencies but out of the fiat system itself.

Analysts say central banks are explicitly exchanging counterparty risk tied to fiat money and government bonds for the non-sovereign stability of gold. The shift is being fueled by three interlinked factors: geopolitical hedging to reduce exposure to Western-controlled financial channels, rising anxiety over fiscal expansion and debt monetization in advanced economies, and a growing loss of confidence in fiat currencies as long-term stores of value. This transition suggests a fundamental repricing of global sovereign risk, with gold increasingly viewed not just as a hedge, but as a parallel anchor of monetary credibility in a fragmenting world economy.

Leave a comment