DHAKA – Rising tariffs on Chinese footwear are driving fresh US demand for Bangladesh’s synthetic leather and non-leather shoes, offering exporters a potential long-term opportunity despite short-term trade disruptions.

Industry leaders say the tariff-driven shift highlights Bangladesh’s growing competitiveness in cost and capacity. While Europe still absorbs nearly 90 percent of the country’s synthetic footwear exports, several producers—including RFL Group, Bling Shoes, Shoeniverse Footwear and Jennys Shoes—report steady growth in American orders.

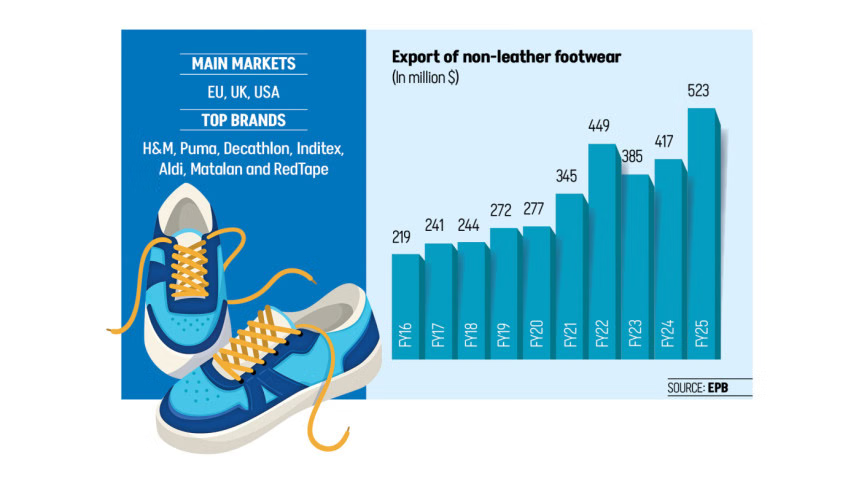

The synthetic leather footwear industry has more than doubled exports over the past seven years, earning $523 million in FY2024-25, up from $244 million in FY2017-18. Globally, synthetic shoes continue to gain traction as a lower-cost, versatile alternative to leather, driving stronger demand from mass-market and lifestyle brands.

However, recent figures show strains from tariff-related uncertainty. Shipments to the US fell to $42 million in August, down 7 percent from a year earlier, as Chinese rivals offloaded discounted products into Europe after losing access to American buyers. Bangladeshi exporters also cited shipment delays and postponed consignments due to unclear reciprocal tariff rules.

Bling Shoes chairman Hasanuzzaman Hassan said the disruption may take months to stabilize, but bulk US orders suggest deeper sourcing shifts are underway. “American buyers are coming back in larger volumes, which shows this is not just a temporary diversion,” he noted, citing Wolverine’s renewed sourcing from Bangladesh after Washington imposed a 47 percent duty on Chinese footwear.

Shoeniverse Footwear’s managing director Riad Mahmud said the European market remains critical, but aggressive Chinese discounting has unsettled exports. The company saw an 8 percent dip in August, though Mahmud expects recovery as capacity expands and the price war eases. “With new factories, we anticipate at least 6 percent monthly growth, provided no fresh shocks,” he said.

Jennys Shoes, which exports mainly to Japan and Europe, also sees the US market opening. Chairman Nasir Khan said the latest tariffs have placed Bangladesh firmly on American brands’ sourcing map. The company has begun processing bulk US orders for non-leather sports shoes, supplying brands like Skechers and Steve Madden.

Meanwhile, RFL Group’s synthetic leather division is securing US orders for both footwear and apparel for the first time. Managing director RN Paul said the company’s eco-friendly polyurethane-based production is attracting global brands including H&M and Zara. To expand capacity, RFL has partnered with a Chinese firm, while also diversifying synthetic leather products into jackets, handbags and wallets for domestic and export markets.

Despite August’s decline, exporters remain optimistic. They argue that structural changes in global sourcing, driven by tariffs and supply chain realignments, could give Bangladesh a stronger foothold in the US footwear market. “There are bumps in the short term,” said Mahmud, “but the long-term opportunity is real—and growing.”

Leave a comment